An enthusiastic FHA bucks-away refinance enables you to faucet the new collateral in your home, however, there are lots of very important qualification standards.

This post is subjected to an extensive reality-examining processes. Our top-notch truth-checkers guarantee blog post pointers up against primary sources, credible publishers, and you will specialists in the field.

I discovered payment in the products stated within tale, nevertheless the viewpoints could be the author's ownpensation can get effect in which also provides are available. I've not included the offered products or now offers. Find out about how exactly we make money and you may our very own editorial guidelines.

A finances-aside refinance loan could help accessibility brand new guarantee on your home to defense the cost of household home improvements, college tuition, or some other huge debts. Collateral 's the matter the property will probably be worth, without any money due with the bank towards a mortgage.

An enthusiastic FHA cash-aside refinance is one way of being able to access family collateral, hence book allows you to decide if this is the right one for you.

- What is an enthusiastic FHA bucks-aside refinance?

- FHA bucks-out re-finance recommendations

- Antique compared to. FHA dollars-aside re-finance: An easy review

- Who is a keen FHA dollars-out refinance suitable for?

- Ideas on how to submit an application for a keen FHA bucks-out refinance

- Conclusion

What is actually a keen FHA dollars-away re-finance?

The new Government Construction Management (FHA) falls under the newest Service out of Property and you may Urban Creativity (HUD), a federal agency intended to give casing service. The newest FHA claims mortgage loans, and therefore the government brings insurance policies getting loan providers but if individuals cannot pay the mortgage number owed. That financing kind of the fresh new FHA guarantees is actually a keen FHA bucks-aside home mortgage refinance loan, enabling eligible individuals to help you tap into their residence collateral.

In the event the recognized to own a keen FHA dollars-aside refinance, you are taking yet another home loan out to your FHA, which repays your entire present home loan and provide you cash back. Such as, if you owed $150,000 on a property having an appraised worth of $300,000, you can take a great $2 hundred,000 cash-aside home mortgage refinance loan. With the financing continues, you'd pay your current $150,000 home loan and you will carry out whatever you wanted into the other $50,000.

Make use of the remaining mortgage proceeds having renovations, to settle https://clickcashadvance.com/installment-loans-wv/ higher-notice credit card debt, and for any purpose. However, you are credit contrary to the security in the home. Meaning you are placing your house at risk of property foreclosure inside the cases of nonpayment, so be wise exactly how far equity your availableness by borrowing from the bank.

An enthusiastic FHA bucks-away refinance loan is one cure for availableness the latest equity of your home. Understanding the difference in bucks-away refinances compared to. domestic collateral loans and you can HELOCs against. home security money makes it possible to pick the best credit option to you.

FHA dollars-away refinance guidance

There are certain standards that borrowers need to meet in order to be eligible for a finances-out home mortgage refinance loan. Because the FHA sets lowest conditions having money it pledges, it is critical to observe that private lenders you'll enforce stricter legislation whenever being qualified consumers when they always do it.

FHA cash-away refinances are also subject to FHA loan constraints. Getting 2021, those people constraints is actually $356,362 to have reduced-cost elements and you can $822,375 to own higher-rates areas.

Minimal credit history

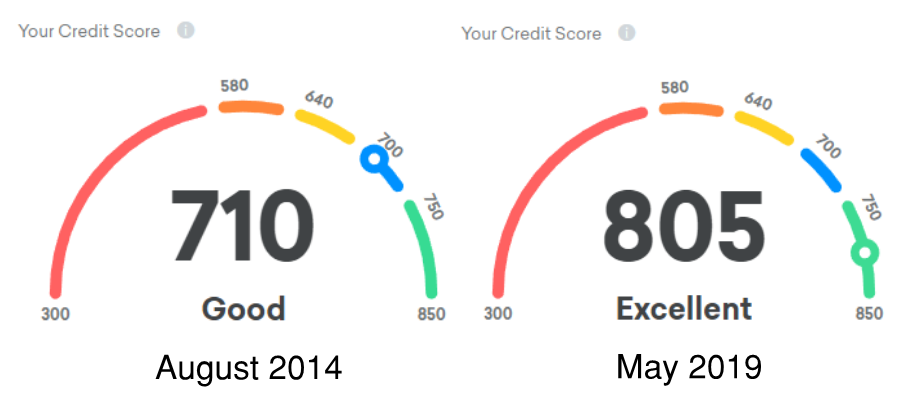

Typically, consumers protecting FHA loans should have the absolute minimum credit score out-of five-hundred. But not, certain mortgage lenders can get enforce a higher minimum credit rating to own cash-aside re-finance money. Specific place its credit rating requirement as high as 580 or 600.

Limitation mortgage-to-worthy of ratio

Lenders do not allow you to obtain 100% of one's value of your house. Alternatively, it lay a maximum loan-to-worthy of (LTV) ratio. That's the ratio of your own number you may be eligible to obtain relative with the appraised property value the house or property promising the borrowed funds.