Ca Va financing limitations play an integral part in the act off bringing lenders to help you energetic armed forces provider players or those who've before offered our nation. Va home loans in California are lenders provided by home loan companies in order to financing individuals inside California, in addition to Va (Veterans Situations) claims a portion of the mortgage. step 1 That it be certain that throughout the Virtual assistant allows home financing company so you can provide fund so you're able to pros within faster terminology.

What exactly are California Virtual assistant Financing Constraints?

California Va financing constraints are certain wide variety a loan applicant is also acquire contained in this a particular state. It is vital to remember that Ca experts which have full entitlement are not susceptible to such restrictions per the new Blue water Navy Vietnam Experts Act out of 2019. dos When the a loan applicant is eligible to have full entitlement and the loan amount is a lot more than $144,000, upcoming California Va loan limitations are waived of the mortgage lender.

For every single Pros Situations, the loan limit will be based upon the quantity the Va will ensure (we.age., the most they'll spend to the bank if an excellent loan candidate defaults to the financing). step three

Full Entitlement Said

Entitlement is the count the newest Virtual assistant will make sure and you may spend so you're able to the lending company in the event the an experienced defaults on the mortgage. A california experienced with complete entitlement is approved for the whole count the newest Va will guarantee. The total amount is both $36,000 or 25% of one's loan amount. Most of the Ca Va funds understand this requirement.

As long as the loan candidate qualifies in other parts (such as for instance income), there's no Ca Va financing limitation to possess pros which have complete entitlement.

Ca Virtual assistant Restrictions Because of the County

To possess veterans that simply don't possess complete entitlement, here you will find the Ca Virtual assistant constraints by the condition. These types of constraints are accustomed to regulate how much that loan applicant who doesn't have complete entitlement is acquire before choosing when they must bring a down-payment.

Full Entitlement Eligibility

You really must be qualified to receive full entitlement to end the brand new California Va loan limits. Extremely loan candidates could well be eligible for complete entitlement, including those to invest in a home the very first time. Here's what is needed:

- The mortgage candidate never utilized your own Va entitlement work with, or

- Obtained paid a previous financing in full and you may marketed the property, otherwise

- A loan applicant got a foreclosure and you can paid down the mortgage in the complete

For as long as the borrowed funds applicant fits among the many a lot more than criteria, a loan applicant is approved to possess complete entitlement. 4 The final devotion have a tendency to slip on the lender, who can follow the guidance granted by the Virtual assistant. When you yourself have questions relating to your Va entitlement, excite definitely ask your mortgage manager.

Providing entitled to a ca Va financing is an easy, step-by-action techniques. Before getting certified, you ought to favor a high-rated mortgage broker and financing manager having at least four several years of feel. And, if you're not qualified to receive complete entitlement, definitely adhere to the fresh new California Virtual assistant loan restrict getting the condition.

See The Quote

The first step of having qualified for a california Va loan is to find a bid and comment the newest conditions. Two key elements we wish to pay attention to are definitely the rate of interest in addition to total quantity of fees are billed (to possess everything you). Of a lot lenders only quotation a number of the charges getting charged, such bank costs, and additionally they neglect 3rd-party charge and you may, occasionally, write off circumstances.

The way to means this will be to inquire of, Which are the full charge to have what you? Asking precisely what the overall fees are leaves your within the a better reputation to understand what try being cited.

you will should ensure your loan number matches their county's Ca Va mortgage restriction (if you don't have full entitlement).

Finally, you will need to South Vinemont AL payday loans inquire the loan officer whether they have cited an increase according to a 30 otherwise forty-five-day secure. Even although you are considering perhaps not locking your own interest straight away, you continue to want the latest quote becoming according to a thirty otherwise 40-five-day lock.

The reason is which: a bid according to a speed that isn't lockable actually an accurate quotation to look at since you have to help you secure they at some point inside the process.

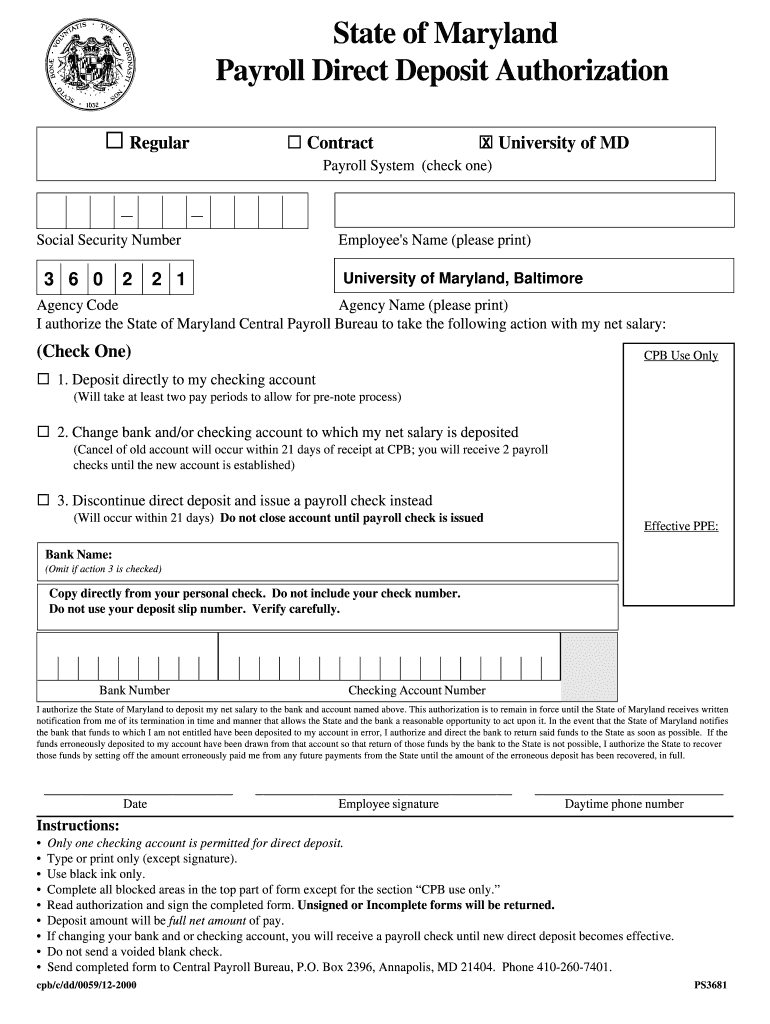

Complete the Loan application

If you'd like the fresh estimate in addition to mortgage manager has demonstrably discussed the charges, you need to following finish the loan application. With many businesses, you can complete the application for the loan for the cellular telephone or on the internet, also it takes throughout the ten to fifteen times doing. To do the loan software, you will want the following first recommendations;

- In case it is a purchase, the house or property address of the house you're to acquire

- Information that is personal particularly term, address, go out out of delivery, personal safeguards number, etc.

- A job pointers

- Water advantage suggestions (we.e., bank account)

Turn in Your Files

When your loan application is finished, you'll want to turn-in your papers. Is a simple range of documents you'll want to posting on financing manager:

- Earnings records

- Liquids asset records

Seek advice from the loan administrator what certain factors you'll need to send in and when any extra issues might possibly be needed. When turning in your own files, make sure the files is clear and over (meaning all the profiles are included).

Underwriter Approval

When your loan manager has had your own done loan application and all of your current requisite papers, they will posting your own document to your underwriter having an entire opinion. Just before creating that, the mortgage officer is check if the loan matter matches your own county's Ca Virtual assistant mortgage maximum amount (without having complete entitlement).

Three Areas The brand new Underwriter Focuses on

Your own file must be considered for these three areas. If you don't have complete entitlement, the latest underwriter might also want to show that you do not meet or exceed your own county's California Va loan maximum. Should your application and you can records meet with the underwriting standards, the underwriter will likely then agree the document and matter requirements to possess closure.

Feedback the fresh recognition and you may closure conditions with your loan officer thus you could potentially proceed that have signing mortgage data files and closing their mortgage.

Last State Into California Va Loan Limitations

New Va mortgage system is an excellent choice to imagine when the you're in the armed forces otherwise have offered.

For those who see a great Va loan, this new Virtual assistant will guarantee up to twenty five% of one's house's worthy of (given your loan balance is at or a lot more than $144,000). Which security be sure lets mortgage brokers giving discount terminology toward Va loans in addition to a no-advance payment option. If you don't have full entitlement towards Va and are generally to find property into the Ca (or refinancing a mortgage), you will have to adhere to your own county's California Virtual assistant loan limitation.

]]>Florida Are designed belongings and you can Fl Mobile Mortgage brokers conditions are almost an identical and tend to be comparable formations which had been situated immediately following Summer fifteen, 1976. From inside the 1976, brand new U.S. Department regarding Property and you will Urban Innovation (HUD) place new shelter requirements towards feeling to own mobile residential property and you will changed the name of those structures moving forward so you can manufactured belongings in the place of cellular. An element of the difference between are created and you may mobile house would be the fact manufactured property follow the latest cover statutes set in motion by the HUD if you find yourself mobile residential property was indeed based just before their execution. Cellular homes were along with will intended to be easily movable, while of numerous are manufactured land aren't made to circulate after they was developed.

The essential difference between Cellular And you may Are manufactured Home

Just before i mention resource, we should explain the difference between a cellular family and you can an effective are manufactured household because they are often made use of interchangeably. A mobile house is a good prefabricated household design built on an excellent long lasting frame which was developed prior to June fifteen, 1976.

A created home is a very comparable design which was dependent once June 15, 1976. Inside the 1976, the fresh U.S. Department off Construction and you can Urban Advancement (HUD) lay the newest protection requirements into the impact to have cellular belongings and you will changed the name of them structures moving forward so you can manufactured house as opposed to cellular.

The main difference in are manufactured and you may mobile land would be the fact are manufactured home comply with the defense statutes put in place from the HUD when you are cellular residential property was in fact created ahead of their implementation. Mobile belongings was basically also often intended to be easily moveable, whereas many are created land aren't made to move once they are come up with.

Simple tips to Be eligible for Florida Mobile A mortgage

Money a cellular otherwise were created house inside the Fl is a bit not the same as resource a home since most loan providers do not thought these types of land qualified to receive really particular mortgage loans. Some loan providers will give you financing for a produced household when it suits the certain standards and you can sleeps towards the a long-term foundation, but sometimes it is difficult otherwise impossible to have are manufactured belongings so you're able to be considered houses, especially if you never very own the homes using your house.

Kind of Money For Mobile, Modular, Are produced Home loans from inside the Fl.

For these seeking financing a cellular otherwise are available house into the Florida, you have several options. Why don't we mention every one and several of one's requirements plus the positives and negatives that can come and additionally them.

Old-fashioned Funds

Extremely loan providers does not give you a conventional loan to have a good mobile or are manufactured family since these formations commonly felt genuine assets. When you have a produced house that suits particular most certain criteria, however, old-fashioned home loan supplies Freddie Mac and Federal national mortgage association carry out in fact give certified loans Portland installment loan with savings account.

Fannie mae

While not all the loan providers money were created property, some , enabling consumers to finance are designed belongings more than thirty years with down repayments as little as step 3%. So you're able to meet the requirements, yet not, your residence should fit most particular standards. For-instance, the home should be at the least several feet wider, features a minimum of 600 square feet, cannot be on rented house, etcetera This type of criteria resemble Fannie Mae's your house must be built on a long-term frame, have to be thought real estate, really needs at the very least eight hundred square feet away from liveable space, etcetera.

FHA Fund

New Government Homes Government (FHA) also provides lenders that have repaired interest rates and lower credit, debt-to-earnings proportion and down-payment conditions that are popular with very first-date home buyers. However they promote are created home loans entitled Term We and Identity II loans.

Name I loans can be used to pick are built home however, not the fresh new residential property on which they stand. There are several fine print, such as that the house or property must be the majority of your residence, it has to fulfill FHA recommendations just before are wear a beneficial local rental site, need to be linked to resources, etcetera. These types of finance are apt to have short terms (normally up to two decades) and you can reduced mortgage constraints.

Title II finance can be used to purchase one another a manufactured house and the home they is for the as you. This type of finance can not be utilized in mobile family areas or into the leased property. Cellular residential property accomplish maybe not meet the requirements because it's required that the family are financed is actually centered just after 1976. This type of finance also require the are created domestic under consideration matters given that real property.

Va Funds

Like a title II FHA mortgage, should you want to purchase a produced home while the land it consist towards the, you can also find a Va financing. Va financing are merely accessible to veterans and you can qualifying active responsibility solution professionals from Department out-of Veteran's Items. There are numerous pros that are included with good Va mortgage, including the capability to place no cash down and get away from paying financial insurance policies.

So you're able to be eligible for a great Va financing for a produced house, your property need to be on a permanent basis, fulfill HUD direction and ought to be obtained toward belongings underneath it; cellular house do not be considered.

Evaluating Latest Florida Are designed Mortgage Costs

Locating the reasonable Florida Are manufactured Financial rates is essential, that's why we have currently featured them to you, having the reasonable rate you can can save you hundreds of dollars a year and thousands of dollars along the longevity of their mortgage. Sure, which have us look for you the best mortgage rates is a huge price.

Current Florida Mobile Home loan Cost

After you Click you'll immediately find the current lower Florida Manufactured Home loan prices. When you see mortgage you love, you can mouse click so you're able to head to ensure you get your Customized Rate Offer.

]]>